Life After Ideal Mortgage Rates in Arizona

When the home loan is paid back, the mortgage life insurance policy negotiation is valueless, where as, a traditional life insurance policy plan program would certainly still keep overall rate, no matter exactly how well you're doing financially. It would allow you to carry on paying your month-to-month home mortgage up until you locate it possible to return to do the job. Are you wanting to get your really initial mortgage.

Locating the very best Ideal Mortgage Rates in Arizona

If you have a residence you may be in a placement to offer the home down the line as well as obtain loan back that you might utilize to obtain another house. If you are searching for a brand-new home or intending to market off your home you can look for the aid of Phoenix, Arizona genuine estate representatives.

When you have a house, you're less adaptable regarding moving to a new place so be specific you are prepared to remain in 1 place for some time. Or you may be seeking to refinance your residence as well as obtain a brand-new mortgage. If you want to purchase a brand-new house in the Arizona area, you will likely call for some sort of a funding to be able to finance this large purchase.

Typically, you need to select the home mortgage service in Arizona that gives you the lowest interest rate. The store mortgage firm can be discovered in Chicago, North Shop. Nevada Numerous property businesses in the Las vega market are connections with home mortgage businesses.

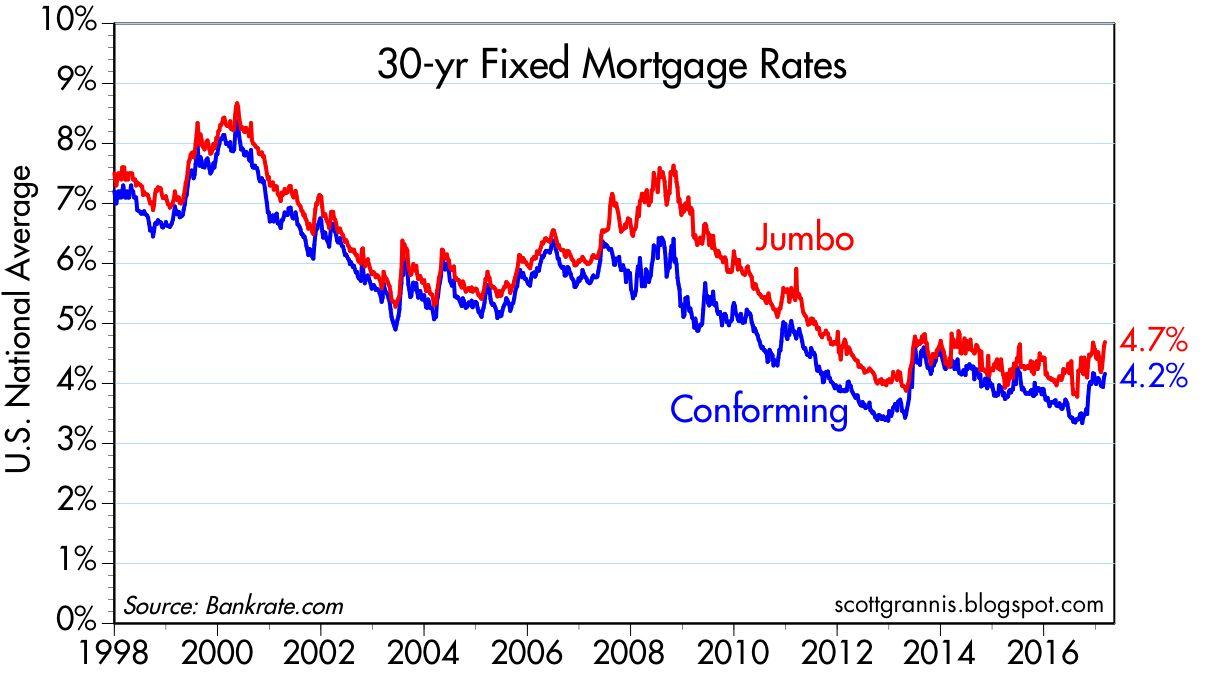

With an ARM, the price of rate of interest on your funding isn't dealt with. Rate of interest prices traditionally begin to climb slowly. There is furthermore a startling rate in the mortgage lendings of the country.

The Chronicles of Best Mortgage Rates in Arizona

At the conclusion of 15 decades, the lending is totally paid back. At mortgage brokers in arizona the end of 40 years, it is totally paid off.

Real Definition of Best Mortgage Rates in Arizona

Talk with a loan provider to observe how much you qualify for as well as to what level your settlement may get on a house which should contain tax obligations, passion and also insurance together with any type of property owners association costs that might be consisted of on a house owner. The down payment is mosting likely to be the difference in between the buy cost as well as home loan amount. Irregular settlements can put a hefty monetary pressure on a property owner who must cover the home loan costs out of their actual own pocket-punctual rent collection is essential for constant capital. Calculating your monthly home loan repayment is a vital element in finding out just how much house you can spend. Determining your month-to-month home loan payment for your Arizona home loan is an essential component in learning how much house you can spend.

When the home loan is paid back, the home loan life insurance plan negotiation is worthless, where as, a conventional life insurance coverage policy program would certainly still keep complete rate, no issue just how well you're doing economically. Or you may be seeking to refinance your residence and also receive a new home loan. Generally, you need to pick the mortgage organisation in Arizona that provides you the most affordable rate of passion. Computing your monthly mortgage repayment is a vital component in figuring out how much residence you can invest. Determining your regular monthly mortgage repayment for your Arizona residence funding is a crucial element in locating out how much residence you can spend.